As businesses adapt to shifting economic demands, many are reevaluating how they manage their finances. Outsourced accounting services are gaining traction not only for their ability to reduce costs, but also for their potential to drive growth and improve operations.

This guide delves into the essentials of modern accounting outsourcing, covering its advantages, implementation strategies, and how to find the ideal partner for your business. Read on.

Understanding Modern Outsourced Accounting Services

The landscape of accounting outsourcing has evolved dramatically with technological advancement. Today’s outsourced accounting services leverage cloud technology, automation, and real-time collaboration tools to deliver comprehensive financial management solutions that go far beyond basic bookkeeping.

Core Services and Capabilities

Modern outsourced accounting solutions typically include:

- Real-time financial reporting and analysis

- Advanced forecasting and budgeting

- Accounts payable and receivable management

- Payroll processing and compliance

- Tax preparation and planning

- Strategic financial advisory services

According to recent industry data, businesses that implement outsourced accounting solutions typically see a 30-40% reduction in operational costs compared to maintaining an in-house team. However, the benefits extend far beyond cost savings.

Key Benefits and ROI of Accounting Outsourcing

Cost Optimization

Making the switch to outsourced accounting services can transform your financial operations through significant cost savings:

- Elimination of full-time salary and benefits expenses

- Reduced technology and training costs

- Scalable service models that align with business needs

- Average savings of $50,000-$150,000 annually for mid-sized businesses

Access to Expertise

Partner with experienced professionals who bring:

- Team of certified professionals with diverse specializations

- Specialized knowledge in various industries

- Continuous updates on regulatory changes

- Access to enterprise-level technology and tools

- Best practices from working with multiple clients

Improved Efficiency

Modern outsourced accounting solutions deliver operational improvements through:

- 24/7 availability of financial data

- Automated routine tasks and workflows

- Faster monthly closing processes

- Real-time reporting capabilities

- Improved accuracy through standardized processes

How to Choose the Right Outsourced Accounting Services Provider

Selecting the right partner is crucial for success. Consider these key factors during your evaluation process:

Essential Criteria

- Industry expertise and certifications

- Relevant industry experience

- Professional certifications

- Track record of success

- Client testimonials and references

- Technology stack and integration capabilities

- Modern accounting software expertise

- Integration with popular business tools

- Custom solution capabilities

- Data migration experience

- Security protocols and compliance standards

- Data protection measures

- Industry compliance certifications

- Regular security audits

- Disaster recovery planning

- Service level agreements and support structure

- Clear response time guarantees

- Escalation procedures

- Regular review meetings

- Performance metrics

- Cultural fit and communication style

- Compatible working hours

- Communication channels

- Language and cultural alignment

- Team accessibility

Technology Compatibility

Your chosen provider should offer:

- Cloud-based accounting software integration

- Secure data transmission protocols

- Mobile accessibility

- Custom reporting capabilities

- Automated workflow tools

Implementation and Integration Strategies

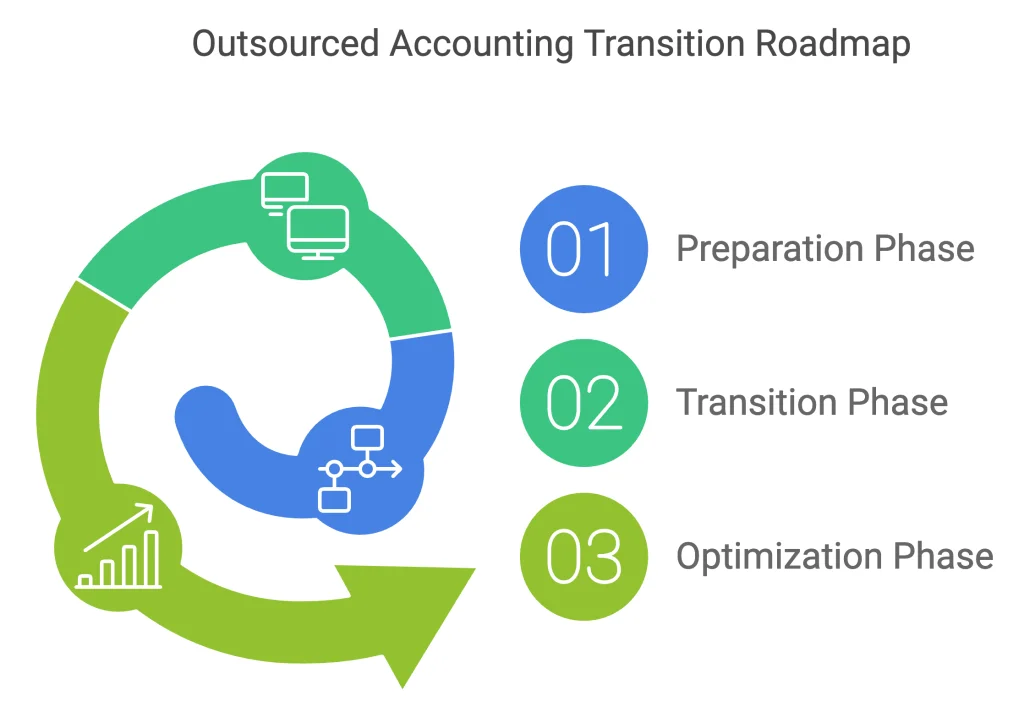

A successful transition to outsourced accounting requires careful planning and execution. Here’s a detailed roadmap:

Phase 1: Preparation

- Document current processes and workflows

- Identify key stakeholders and responsibilities

- Set clear objectives and timelines

- Establish communication protocols

- Create data migration plan

Phase 2: Transition

- Data migration and system setup

- Team training and orientation

- Process testing and refinement

- Initial performance benchmarking

- Launch monitoring systems

Phase 3: Optimization

- Regular performance reviews

- Process refinement based on feedback

- Technology optimization

- Scaling services as needed

- Continuous improvement initiatives

Security, Compliance, and Best Practices

Data security and regulatory compliance are paramount in accounting outsourcing. Here’s what you need to know:

Security Measures

- End-to-end encryption for all data transmission

- Multi-factor authentication for system access

- Regular security audits and penetration testing

- Disaster recovery and business continuity planning

- Employee security training and monitoring

Compliance Standards

- GDPR compliance for data protection

- Industry-specific regulatory requirements

- Data privacy and retention policies

- Audit trail maintenance

- Regular compliance updates and training

Maximizing Value from Your Outsourced Accounting Partnership

To ensure long-term success with your outsourced accounting solutions:

- Establish clear communication channels and protocols

- Set measurable performance metrics and review regularly

- Invest in relationship building with your service team

- Stay involved in strategic financial decisions

- Regularly review and update service requirements

Transforming Your Business Through Strategic Accounting Partnerships

The future of accounting is digital, data-driven, and increasingly outsourced. By partnering with the right service provider, businesses can transform their financial operations from a cost center to a strategic asset that drives growth and innovation.

Key success factors include:

- Clear alignment of goals and expectations

- Strong communication and collaboration

- Regular performance monitoring and optimization

- Continuous process improvement

- Strategic use of financial insights

Your Next Steps

- Assess your current accounting needs and pain points

- Research and evaluate potential service providers

- Request detailed proposals and service agreements

- Plan your transition timeline and resources

- Develop your implementation strategy

Ready to Transform Your Financial Operations?

Whether you’re just starting to explore outsourcing options or ready to make the transition, our expert team provides comprehensive back-office accounting and bookkeeping services that can help streamline your financial operations while reducing costs. We understand that each business has unique needs, and our tailored solutions ensure you get the right level of support for your organization.

For a deeper dive into how our specialized accounting and bookkeeping solutions can benefit your business, explore our professional accounting and bookkeeping services in the Philippines. Our team of certified professionals is ready to help you achieve your financial goals while maintaining the highest standards of accuracy and compliance.