Handling insurance claims efficiently is essential for delivering a seamless customer experience. Whether you’re an insurance provider or a third-party administrator, claims management plays a crucial role in maintaining customer satisfaction and ensuring a smooth claims process.

In this guide, you’ll learn what claims management is, why it matters, the key steps involved, and the challenges that can arise. Plus, we’ll explore ways to improve the process for better results. Let’s get started!

What is Claims Management in Insurance?

Claims management is the process of handling insurance claims from the moment they are reported until they are resolved. It ensures that claims are assessed fairly and in line with policy terms and legal requirements. This process involves reviewing claim details, verifying information, and determining payouts based on the coverage provided.

Insurance companies use various tools, such as claims management software and mobile apps, to organize and track claims efficiently. Claims adjusters and insurance professionals oversee the process to ensure accuracy and compliance. A well-structured claims management system helps maintain order and consistency in handling claims, making it an essential part of the insurance industry.

Why is Claims Management Important in the Insurance Industry?

Handling claims the right way is key to keeping customers happy and running a smooth insurance operation. A strong claims management process helps prevent delays, reduce costs, and ensure fair claim decisions. Here’s why it matters:

Happy Customers, Stronger Trust

When someone files a claim, they want a quick and hassle-free experience. Long wait times and confusing steps can be frustrating. A well-organized claims management system speeds up the process, keeping customers satisfied and strengthening their trust in your company.

Stopping Fraud Before It Costs You

Fraudulent claims can drain company resources and lead to higher costs for everyone. With data analytics and smart fraud detection tools, insurers can catch suspicious claims early and prevent unnecessary payouts, saving money while keeping policies fair for honest customers.

Faster Claims, Fewer Errors

Manually processing claims is slow and often leads to mistakes. With claims management software, insurers can automate routine tasks, reduce paperwork, and minimize human errors. This speeds up the claims process, helping you handle more claims efficiently and accurately.

Staying on the Right Side of the Law

The insurance industry is filled with strict regulations, and breaking them can lead to legal trouble and hefty fines. A well-structured claims management process ensures that every claim follows industry rules, keeping your company compliant and avoiding risks.

Fair Payouts, No Guesswork

No one wants to feel short changed—or overpay on a claim. Claims adjusters and insurance professionals carefully review claims using real data to ensure fair and accurate payouts. This prevents disputes and builds long-term trust with policyholders.

A Reputation That Sets You Apart

How you handle claims shapes how customers see your company. A slow, confusing, or unfair claims process can damage your reputation, while fast and transparent claims handling builds a name for reliability, professionalism, and top-notch customer service.

Key Steps of an Effective Claims Management Process

A smooth claims management process helps avoid delays and ensures fair claim settlements. Here’s how it works:

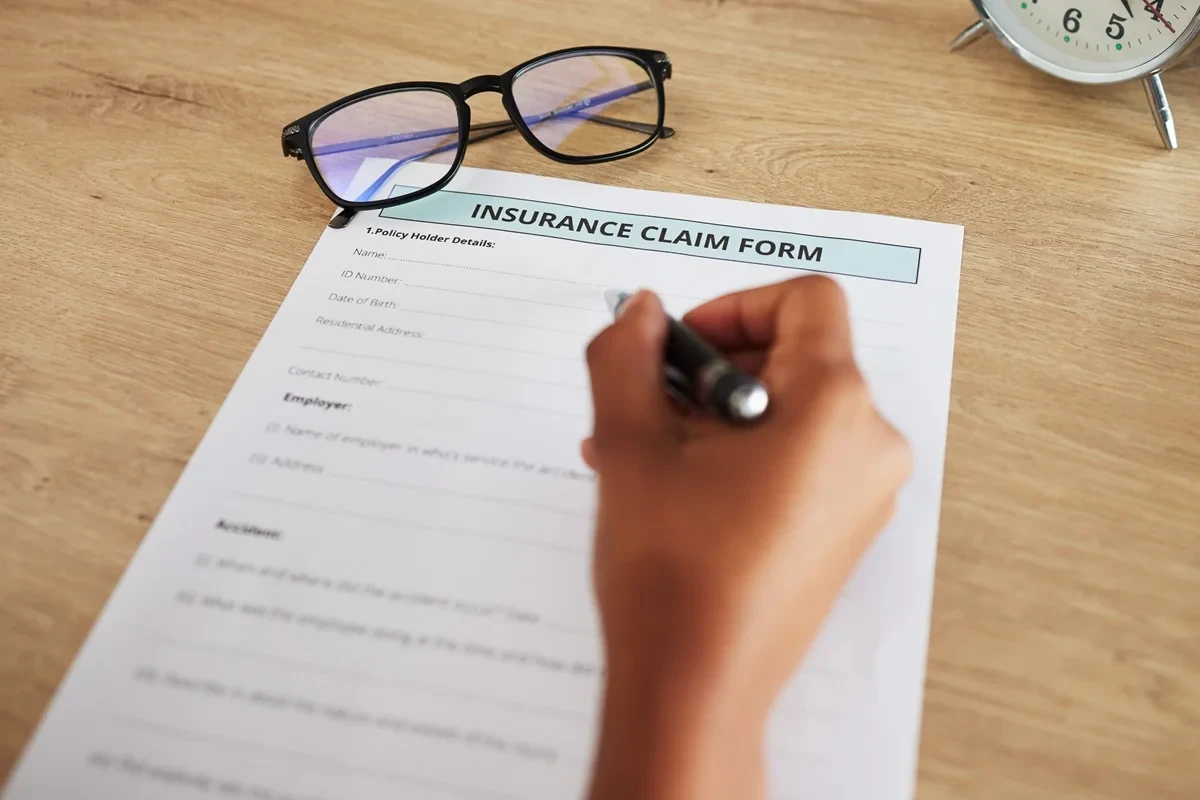

1. Collecting Claim Details and Documents

The process starts when a customer submits a claim. This includes providing policy information, details about the incident, and supporting documents. Many insurers now use mobile apps and online portals to make this step easier and faster for customers.

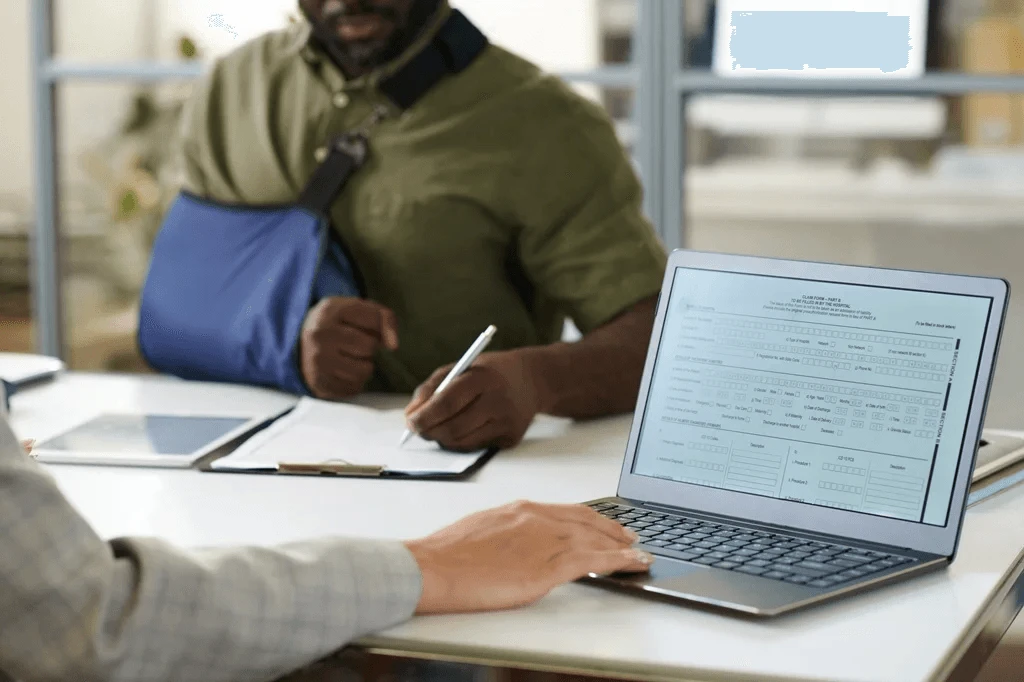

2. Checking the Claim and Investigating

Once a claim is received, it needs to be reviewed for accuracy. Insurers check policy coverage and verify the details. Claims adjusters may inspect damages, gather statements, and assess whether the claim is valid.

3. Spotting Fraud and Assessing Risks

Not all claims are genuine. By analyzing claims data and using AI-powered fraud detection tools, insurers can identify suspicious patterns and prevent fraudulent claims from being paid out. This step protects the company from financial losses and helps keep premiums fair.

4. Making a Decision: Approval or Rejection

After reviewing all the information, the insurer decides whether to approve or deny the claim. This decision is based on policy terms and the evidence provided. Clear and timely communication at this stage is crucial to maintaining customer satisfaction and trust.

5. Paying Out Settlements Quickly

For approved claims, insurers calculate the payout and process the payment as soon as possible. A well-organized claims management system ensures accurate settlements, smooth financial transactions, and a positive experience for policyholders.

What are the Possible Challenges?

Even with modern claims management software, insurers still face several obstacles that can slow down operations and impact customer satisfaction. Here are some of the biggest challenges:

- Delays in Processing Times – Inefficiencies in workflow can lead to long wait times, frustrating customers and affecting their trust in the company. A slow claims process can also increase operational backlogs.

- High Operational Costs – Managing claims in-house requires a significant investment in staffing, training, and technology. Without an optimized claims management system, expenses can quickly add up.

- Fraudulent Claims – Insurance fraud is a major issue, costing the industry billions every year. Detecting and preventing fraud requires advanced data analytics and risk assessment tools.

- Regulatory Compliance – Insurance regulations change frequently, making it difficult for companies to stay compliant. Failing to meet industry standards can result in legal penalties and reputational damage.

- Inconsistent Customer Service – A disorganized claims management process can lead to miscommunication, lost documents, and frustrated policyholders. Poor service not only affects claim resolution but also damages long-term customer relationships.

Why Is Outsourcing Claims Management a Smart Business Move?

Handling insurance claims can be complicated and time-consuming. Many insurance providers now turn to claims management services to make the process smoother and more efficient. Here’s why outsourcing can be a great choice:

Save Money Without Sacrificing Quality

Managing claims in-house means hiring, training, and paying a full team, plus investing in expensive technology. Outsourcing gives you access to experienced insurance professionals at a lower cost, helping you cut expenses without lowering service quality.

Speed Up the Claims Process with the Right Tools

Outsourcing companies use the latest claims management software, data analytics, and automation tools to process claims faster and with fewer mistakes. This reduces processing times and makes the whole experience smoother for both you and your customers.

Provide Better Customer Service

Customers expect quick and clear updates on their claims. Outsourcing teams specialize in handling customer inquiries, making sure policyholders get fast responses and helpful support. This improves customer satisfaction and builds trust in your services.

Reduce Fraud Risks

Insurance fraud can lead to huge financial losses. Outsourcing providers use advanced fraud detection tools to spot suspicious claims early, helping you prevent unnecessary payouts and protect your business from fraudsters.

Stay Compliant with Changing Regulations

Insurance rules and regulations are always changing. Keeping up with them can be a challenge, but outsourcing partners stay updated and ensure that your claims management process follows the latest industry standards. This helps you avoid legal trouble and keeps your business running smoothly.

Streamline Your Claims Management Process with Reliable Outsourcing Solutions

Handling insurance claims can be challenging, especially with strict regulations and the risk of fraud. Managing everything in-house takes time, resources, and expertise. If claims processing is slow or inefficient, it can lead to frustrated customers and higher costs.

Outsourcing offers a smarter way to manage claims. With the help of experienced professionals and advanced claims management services, you can speed up processing times, improve fraud detection, and ensure accuracy in every claim. Using the latest claims management software and data analytics, outsourcing providers help reduce errors and keep operations running smoothly.

If you want a more efficient claims management system, outsourcing can make a big difference. Get in touch today to see how expert claim processors can help you save time, cut costs, and improve customer satisfaction.